Market Commentary

December 1st 2021

IN THE NEWS DURING NOVEMBER:

● Coinbase now in the top 20 banks/financial institutions in the entire world by

Market Cap at $90 Billion. Twice as big as Barclays and 50% bigger than

CapitalOne. (Coinbase is the largest centralised, fully regulated, Crypto

Exchange in The US).

● BlockFi has filed with the SEC to launch a spot Bitcoin ETF.

● Bitcoin miners were paid $61.8 million to secure the bitcoin network over a 24

hour period.

● Nov 14. Van Eck’s spot Bitcoin ETF hearing in front of The SEC resulted in permission for a new ETF being turned down which unsettled markets. Other ETFs in the pipeline. Fidelity launched a spot bitcoin ETF in Canada. We still believe that is it only a question of time before first Spot Btc approved by SEC.

● The Crypto Economy passes $3 Trillion Market Capitalisation.

● MicroStrategy has purchased an additional 7,002 bitcoins for $414.4 million in

cash at an average price of $59,187 per Bitcoin. As of 11/29/21 they hold

121,044 bitcoin.

Issues unsettling the market in November

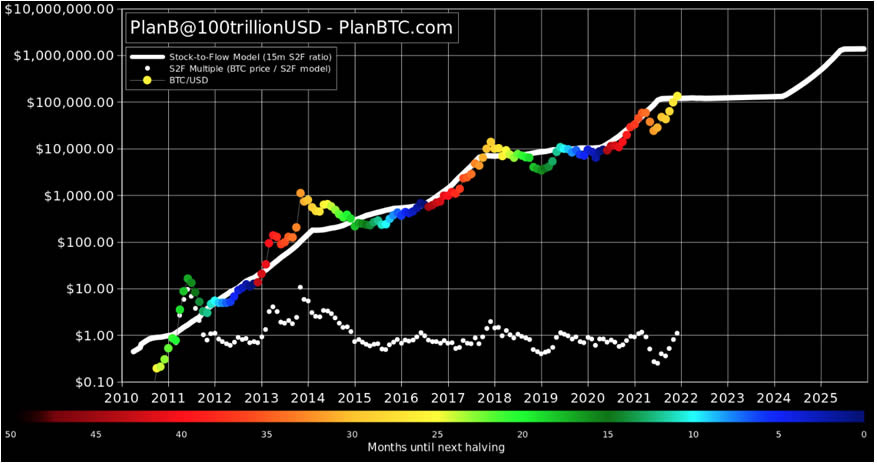

According to stock to flow analysis November began on track for significant gains - markets stalled mid months a result of several issues.

Conversations in The US were centred around fears of Inflation. The Dow had three consecutive red candles on the weekly since the first week of November.

News of a new Covid Variant during Week 2 instilled fears of a global shutdown, and a repeat of March 2020. It is beginning to appear that this time concerns are being managed. Bitcoin and the entire Crypto space is still perceived as a Risk-on-Asset, so fear in traditional markets remain correlated onto digital financial assets..

In the Bitcoin World, news was dominated by progress in legal proceedings in the case of Creditors of Mount Gox - an exchange that went into administration in 2014 freezing the assets of investors. For a short time there were suggestions that frozen Mount Gox Bitcoins may be released onto the market - 141,000BTC - saturating the market. While The Trustees have settled the terms of repatriation, payouts are highly unlikely before Q2 of 2022, with many complex issues are still to be resolved. Not least Know Your Client (KYC) considerations which were more primitive in 2011-2014..

DECEMBER OPTIMISM?

Interest in the Mount Gox repatriation of BTC is likely to drive more interest back into the sector.

The Halvening Cycle is still technically in play. From December 1st 2017 to the top on December 18, Bitcoin rose 76%. While this is possible, there can be no doubt the market is maturing, and we expect this Bull Run to stretch well into Q1 of next year.

Finally, and back to The Stock-to-Flow chart. November’s poor month has not altered the chart which points to gains in BTC.